A Liquidity Crisis Can Best Be Described as Follows

Managing the Liquidity Crisis. When the flow of money becomes difficult the world can literally come to a standstill.

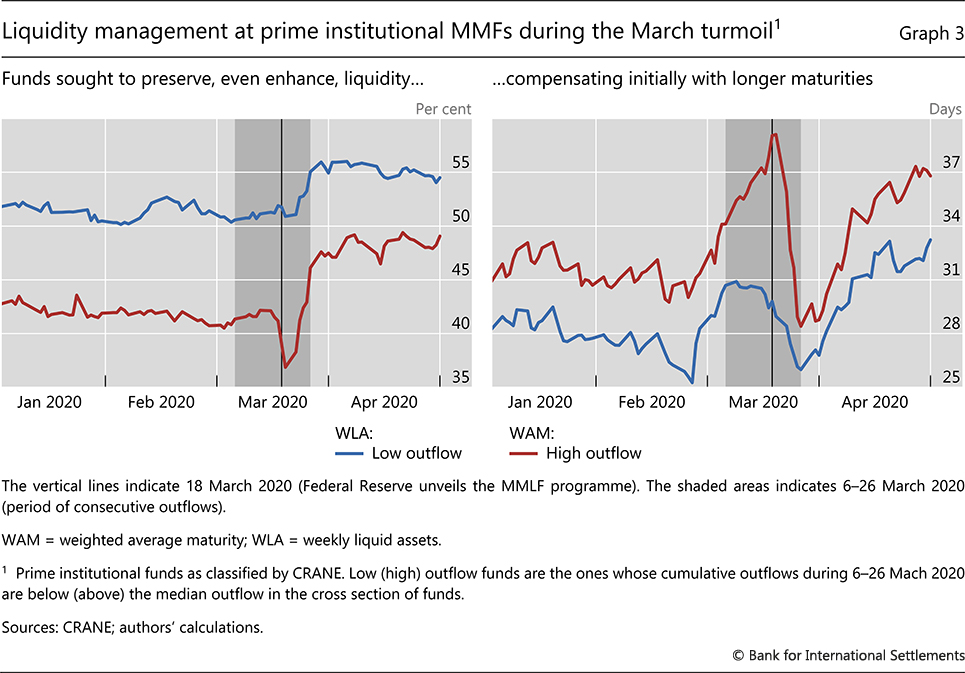

Investor Size Liquidity And Prime Money Market Fund Stress

Even Australia is hunting money aggressively.

. By John Benjamin Last updated Nov 8 2021. A ratio of less than 1 means the company faces a negative working capital and can be experiencing a liquidity crisis. Cash funding liquidity the ease with which borrowers can obtain external funding or accounting liquidity the health of an institutions balance sheet measured in terms of its.

Liquidity Crisis. According to the characteristics of systemic risk spillover and contagion the mechanism of liquidity commonality can be described as follow. This is also where the term comes to liquidate.

Think of it this way. The shadow of a liquidity squeeze. When a crisis occurs the price of some asset drops sharply and triggers its own liquidity.

B During a liquidity crisis the Fed should act as a lender of last resort. The main objective of this study is to create an. Liquidity can be described as the degree of ease with which assets or security can be converted into cash.

Additionally some economists define a market to be liquid if it can absorb liquidity trades without large changes in price. Liquidity crises can be triggered by large negative economic shocks or by normal cyclical changes in the economy. The maturity of its less.

It is dependent on the amount of current asses particularly cash and trade that a business has on hand to pay its current liabilities. In financial economics a liquidity crisis refers to an acute shortage or drying up of liquidity. A company or individual that fails to meet its short-term financial obligations ie the inability to convert assets into cash without incurring a loss can call attention to liquidity risk.

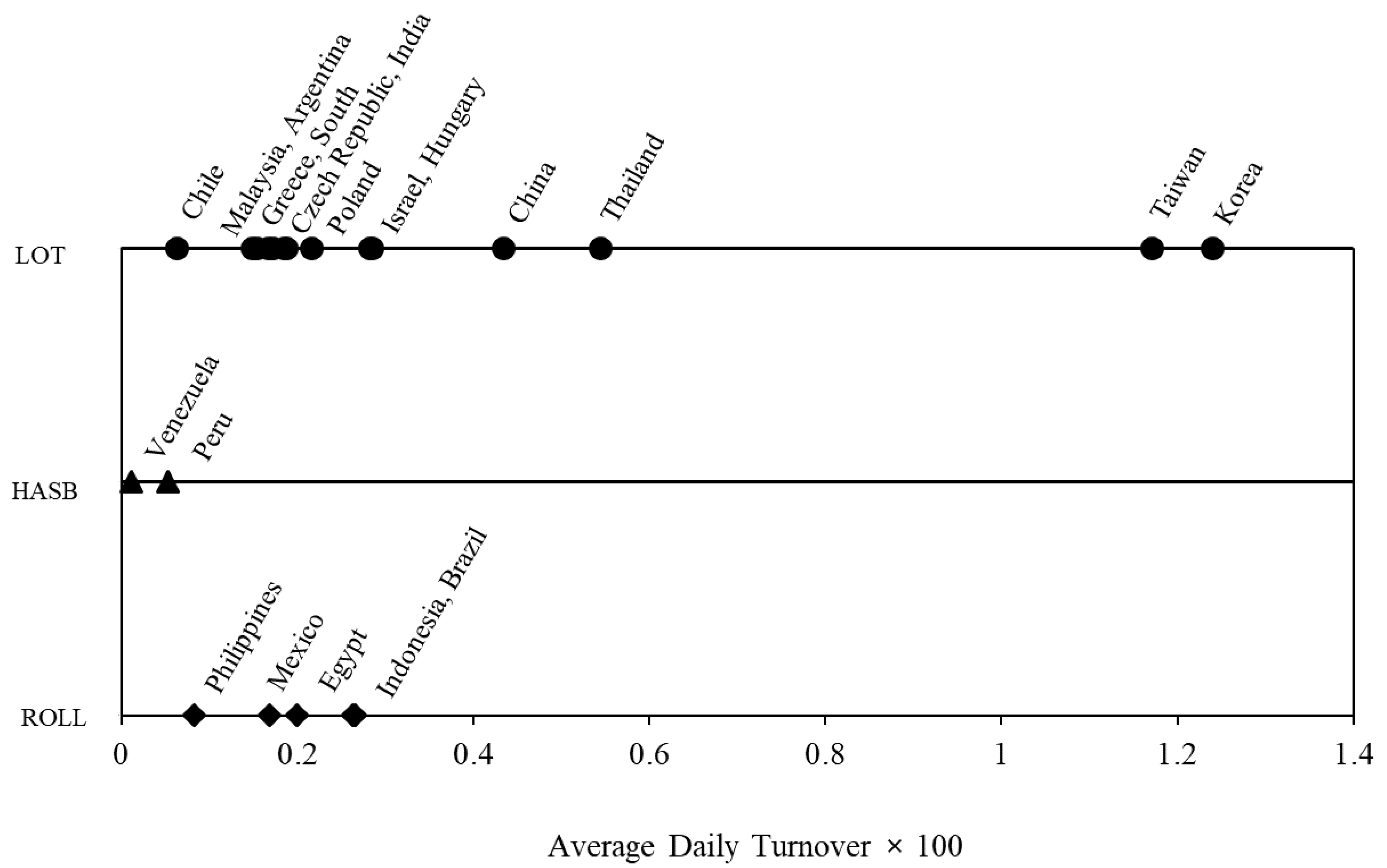

Largely because the low-interest environment following the 2008 financial crisis made it easy for companies to borrow. Liquidity commonality effect is the convergence of liquidity changes. This is causing dollar hoarding and there are more 100 bills in circulation now with 70 of the physical money supply being hoarded OUTSIDE the USA.

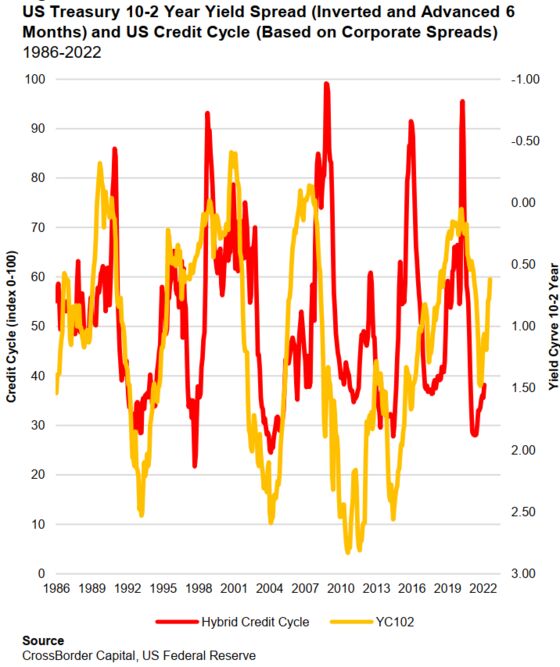

This shortage of liquidity could reflect a fall in asset prices below their long run fundamental price. Over the past few months theres been a lot written about a shadow hanging over bond markets. The financial crisis of 2007-08 is recognised to be the worst crisis since the Great Depression of the 1930s and as a result liquidity risk in the interbank market has gained increased attention.

A liquidity crisis is economic and financial terminology for a shortage of liquidity. The higher the ratio is the more likely a company is able to pay its short-term bills. Businesses left languishing due to social distancing practices during the first weeks of the COVID-19 pandemic must reenergize their operations.

Liquidity crisis is often synonymous with a financial crisis. Where have you heard about liquidity crises. Certain economists state that a market is liquid if it can consume liquidity trades without large shifts in price.

Creditors analyze liquidity ratios when deciding whether or not they should extend credit to a company. A subscription purchase is the best way. The collection of many small deposits from many savers together into a liquid pool that can be loaned out in large amounts to a firm A saver can invest for a two-year horizon while a borrower can borrow for 30 years The shares of a commercial bank.

However a banks liquidity situation particularly in a crisis will be affected by much more than just this reserve of cash and highly liquid securities. A liquidity crisis is a financial situation characterized by a lack of cash or easily-convertible-to-cash assets on hand across many businesses. After all when liquidity dries up the flow of money becomes difficult.

1 Liquidity may refer to market liquidity the ease with which an asset can be converted into a liquid medium eg. Which of the following best describes the liquidity transformation function of a bank. Put on a scale liquidity is highest when dealing in cash and when an asset goes liquid it means that it is sold in exchange for cash.

In financial market terms a liquidity crisis is defined as the ability to convert an asset into cash. Thus the effects of liquidity crisis can quickly snowball into something big if not. It can refer to various types of liquidity including funding market and accounting liquidity.

We have a liquidity crisis unfolding because of massive uncertainty. Liquidity can at times help facilitating transactions. Working capital is another way of measuring liquidity.

One of the earliest and most influential models of. At the root of a liquidity crisis are widespread maturity mismatching among banks and other businesses and a resulting lack of cash and other liquid assets when they are needed. But minuses stock from the list of liquid assets because inventory may not be easy to sell in a crisis.

Liquidity risk measures a companys or individuals ability to use assets to meet short-term financial obligations without incurring major losses. However this is swiftly changing as countries adopt digital means of. A liquidity crisis can arise even at healthy companies if circumstances arise that make it difficult for them to meet short-term obligations such as repaying their loans and paying their employees.

Liquid assets are securities like stocks as they always have a secondary market available for trading. Assets that turn to cash easily are said to be liquid. A liquidity crisis is when you have to call your parents and ask them for a couple of hundred bucks to help cover the rent.

Which Best Describes Liquidity Risk. Why Thinking Like a Startup Can Help Businesses Recover. Prolonged exposure to liquidity risk could lead to the inability to meet short-term financial obligations which could increase the risk of insolvency.

For most weeks of revenue loss have reduced cash flow threatening the crucial liquidity that businesses now need to move. In the event of a bank run or a run on the repo market the Fed can always add liquidity to the system and there will be occasionsas in 1930 and in the fall of 2008when it. In financial economics a liquidity crisis refers to an acute shortage of liquidity.

Liquidity may refer to market liquidity funding liquidity or accounting liquidity. In October Draghi leaves and Lagarde enters who believes the answer is to eliminate cash.

Macroprudential Liquidity Stress Testing In Fsaps For Systemically Important Financial Systems In Imf Working Papers Volume 2017 Issue 102 2017

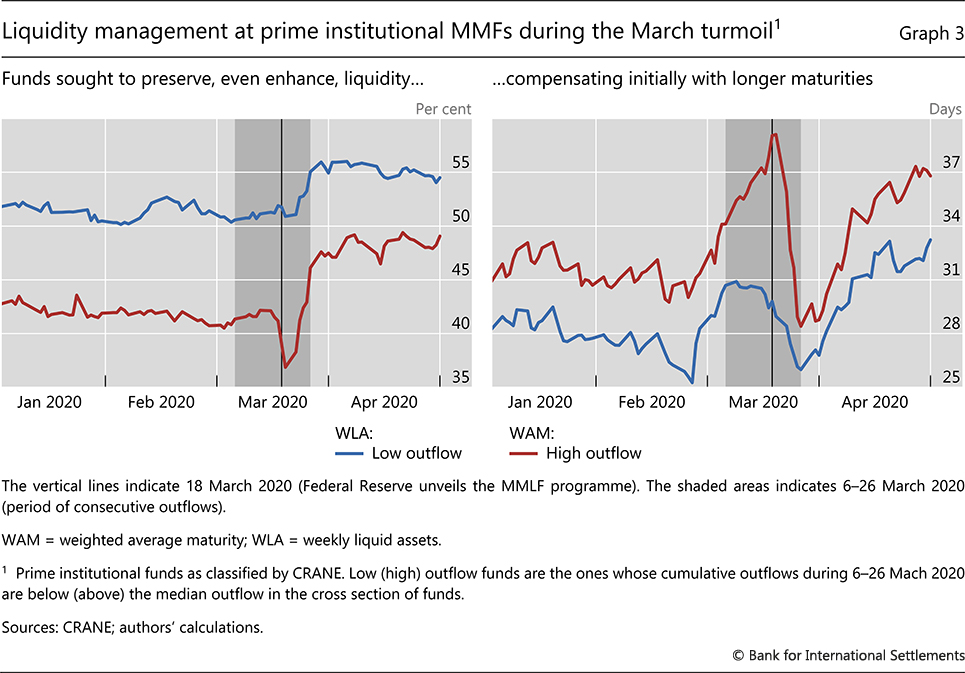

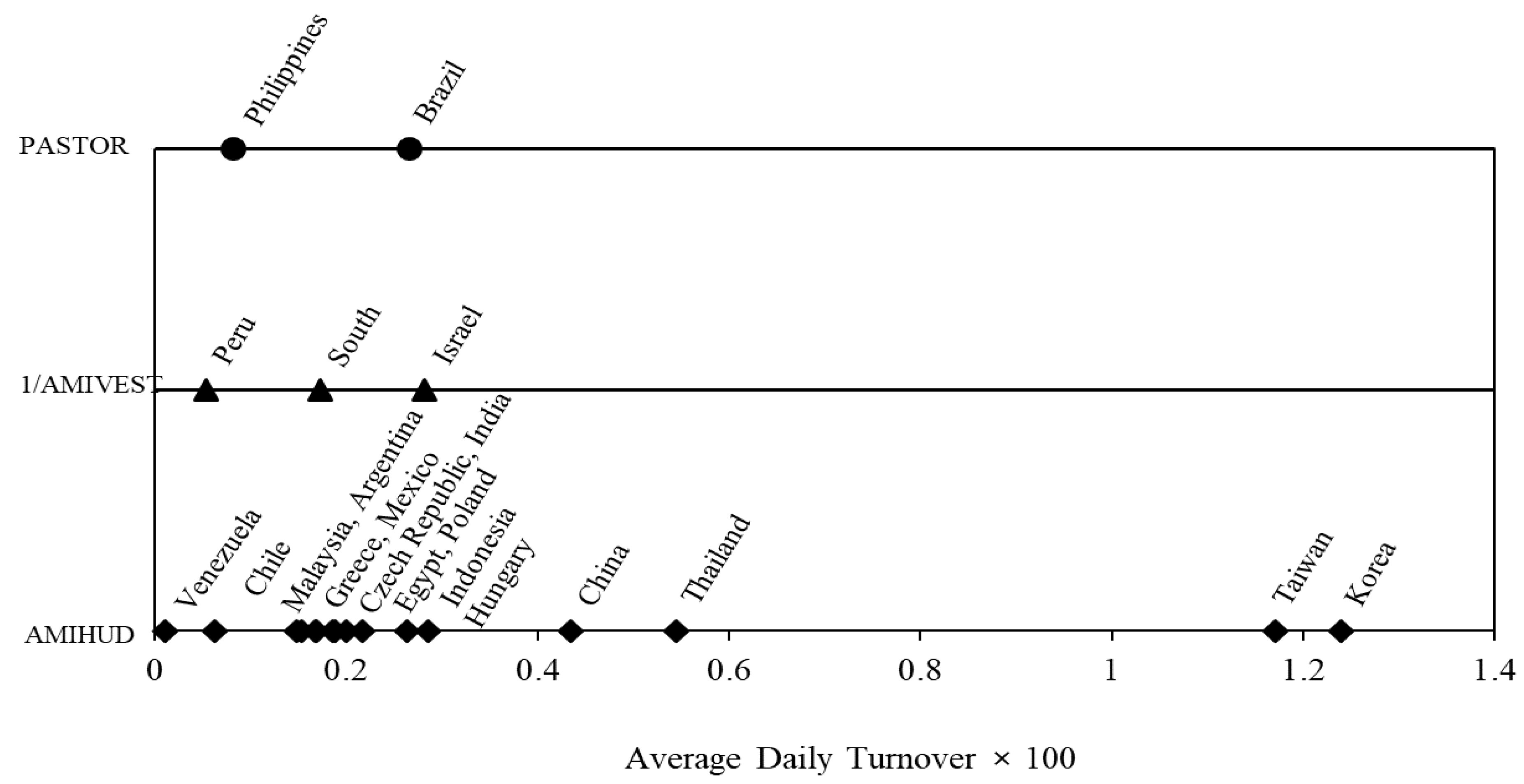

Economies Free Full Text Which Liquidity Proxy Measures Liquidity Best In Emerging Markets Html

Liquidity Distribution And Settlement In Target2

Global Liquidity House Prices And Policy Responses Sciencedirect

All That Pandemic Liquidity Finally Led To Erosion

Covid 19 Tourism S Liquidity Problem Norway 2021 Statista

Forex Trading For Maximum Profit The Best Kept Secret Off Wall Street Hardcover Walmart Com Forex Trading Forex Forex Brokers

Liquidity Distribution And Settlement In Target2

All That Pandemic Liquidity Finally Led To Erosion

Liquidity Effect An Overview Sciencedirect Topics

Liquidity Risk Management Framework For Capital Estimation Risk Management Asset Liability Management Management

Liquidity Risk Definition Example Measurement Of Liquidity Risk

The Econometrics Of Financial Markets By Campbell Lo Mackinlay Financial Markets Financial Financial Modeling

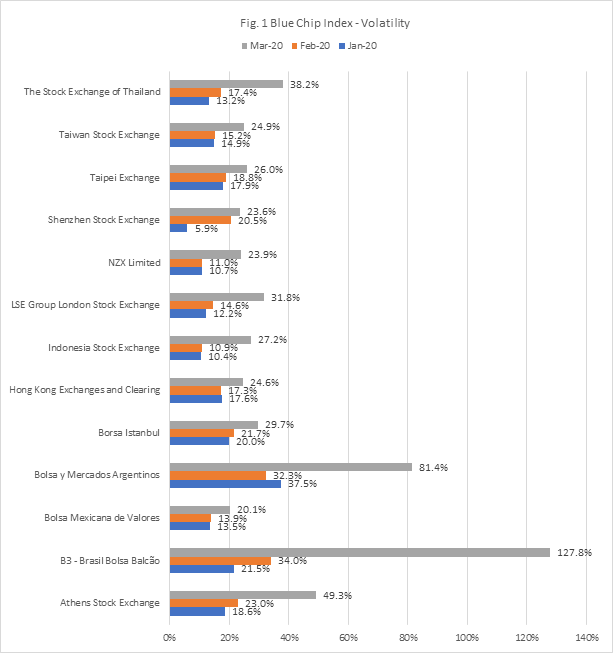

Market Liquidity During The Coronavirus Pandemic The World Federation Of Exchanges

China Liquidity Crunch Roils Global Markets Wells Fargo Investment Institute

Economies Free Full Text Which Liquidity Proxy Measures Liquidity Best In Emerging Markets Html

Comments

Post a Comment